Perth is currently a tenant’s market and is likely to remain that way for the foreseeable future. Here’s a quick snapshot ...

Perth’s CBD office vacancy increased by 1.9% to reach 17% in H1 2025, the highest level in four and a half years. The rise was driven by the completion of 9 The Esplanade, which added fresh supply to the market, coupled with subdued tenant demand through the first half of the year.

By grade, A-Grade assets bore the brunt, with vacancy jumping from 14.2% to 18.5%. Premium stock edged higher by 1.4 points to 10.8%, while B-Grade was largely steady, up just 0.1 points. Net absorption was negative at -4,599 sqm over the half.

Looking ahead, Perth faces a period of supply stability, with no further completions expected in the near term. The next development wave is mooted for 2030, with Lot 4 Elizabeth Quay and 15 The Esplanade in planning. Beyond this, 2031 may bring projects such as the Convention Centre and The Mill.

With limited new supply in the pipeline but demand still soft, we expect vacancy to edge higher over the next 12–18 months before gradually beginning to decline as the market rebalances.

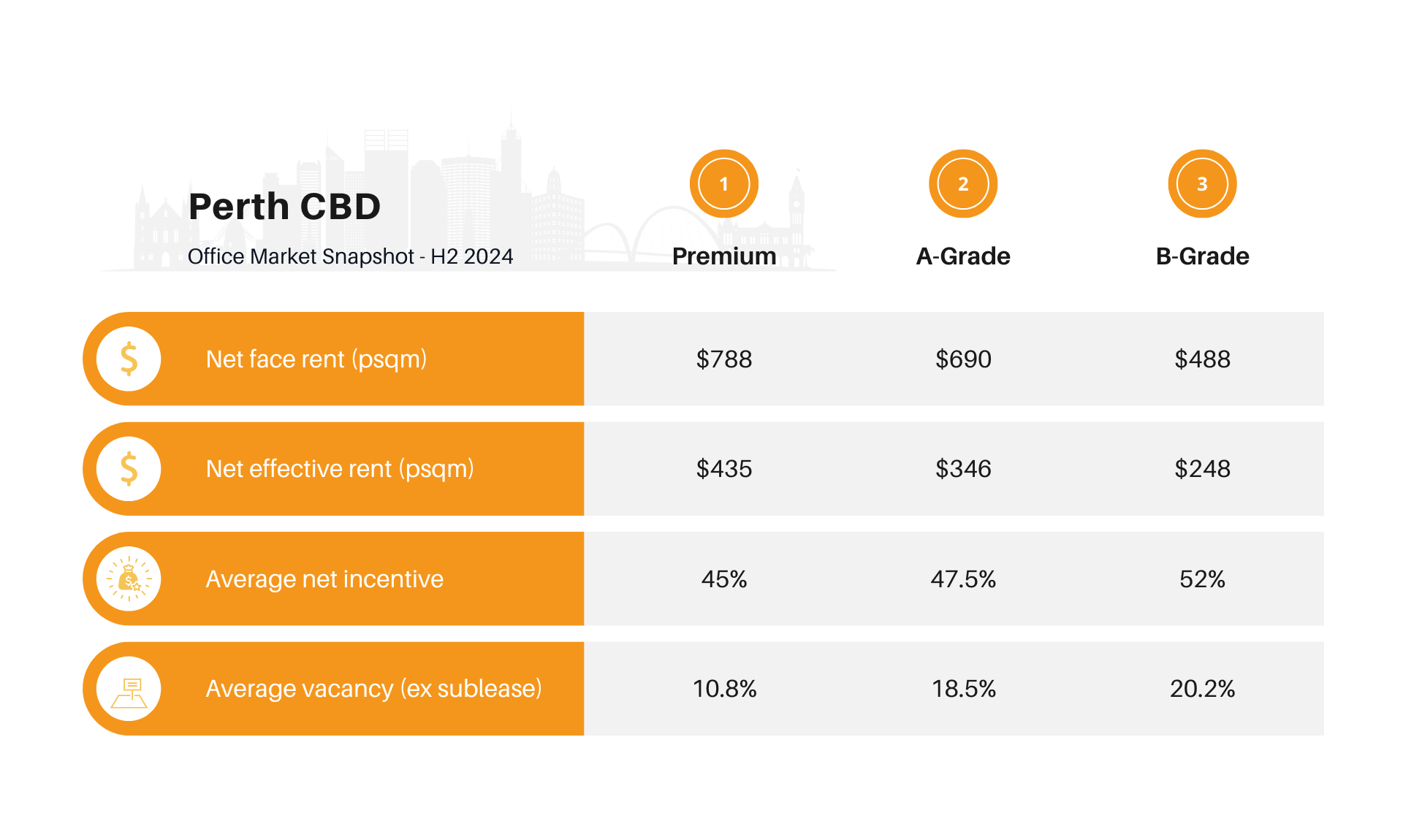

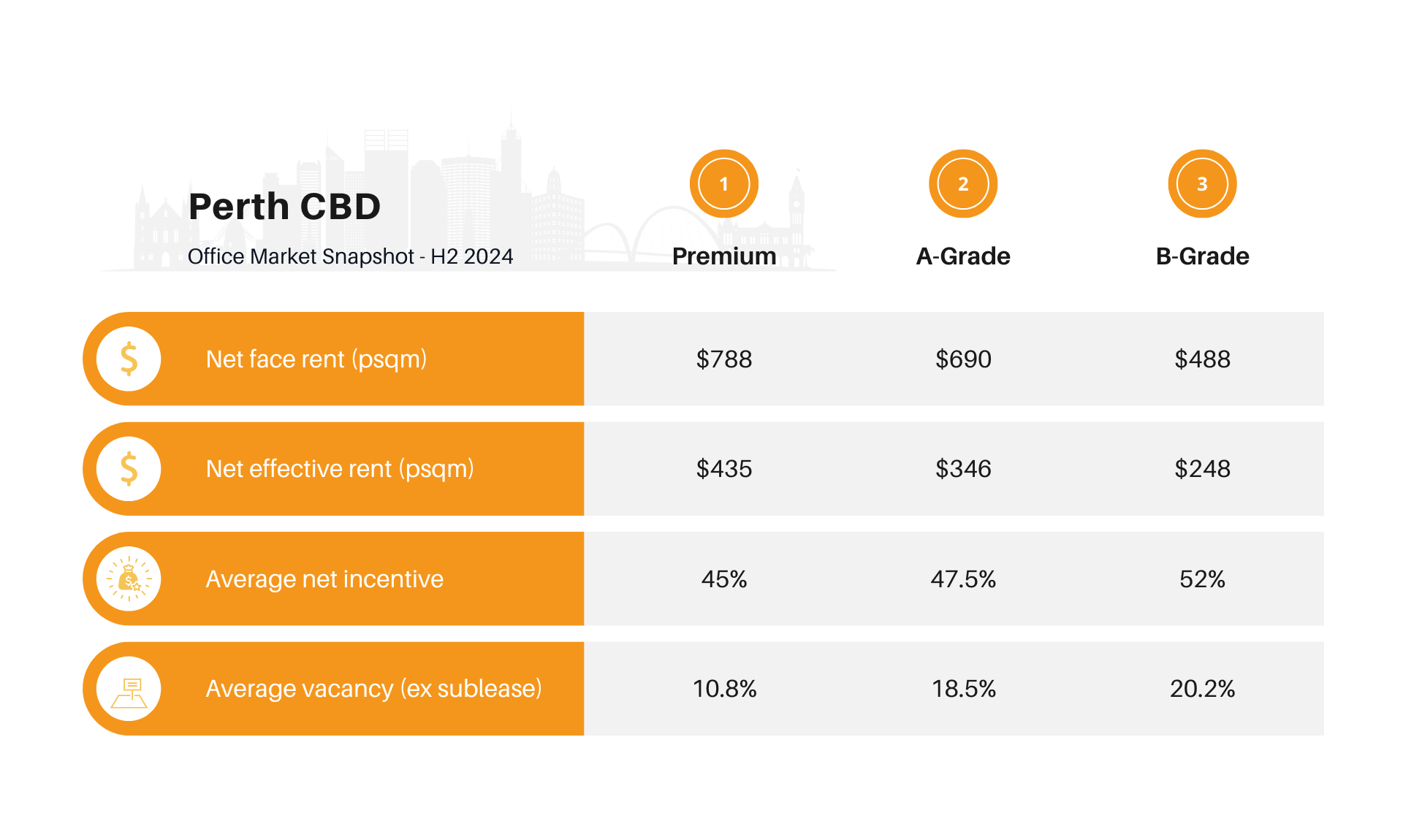

Face rents have recorded modest growth since H2 2024, with increases across all asset grades. Premium rents rose 1.7% to $788/sqm, while A and B Grade each lifted 2.7%, to $690/sqm and $488/sqm respectively.

Effective rents also moved higher, supported by stable incentives. Premium effective rents grew 2.1% to $435/sqm, A Grade edged up 0.6% to $435/sqm, and B Grade surged 8.8% to $248/sqm.

Incentives showed minimal change compared to H2 2024, with the exception of B Grade, which increased by 2.5% to 52%. Premium and A Grade held steady at 45% and 47% respectively. On an annual basis, incentives have declined by 2.5 percentage points in Premium, and by a marginal 0.1 point in B Grade.

Subleasing in the Perth CBD sits at 1.4% of total stock, or 25,664 sqm, in H1 2025, a slight decrease of around 1,800 sqm compared with late 2024.

This follows a period of sharp growth through 2024 and into early 2025, when sublease availability climbed to 1.5% of stock (26,800 sqm). The uplift was largely driven by major occupiers including Chevron, which placed 7,400 sqm on the market at One The Esplanade, and Worley at Dynons Plaza. Even with these increases, sublease levels remained below the 10-year average of 37,000 sqm, with the bulk of activity stemming from the mining and resources sector as well as professional, scientific and technical services.

Some of the recent notable commitments shaping the Perth CBD market include:

With Nine The Esplanade now completed, Perth CBD has entered a period with no new supply due in the near term. The next potential projects, Lot 4 Elizabeth Quay and 15 The Esplanade, are mooted for around 2030, with larger developments such as the Convention Centre redevelopment and The Mill flagged for 2031.

In the short term, subdued demand means vacancy is expected to edge higher over the next 12–18 months before gradually tightening as supply remains constrained. This keeps conditions firmly in favour of tenants for now, with landlords competing on incentives and flexibility. Over the medium to long term, however, the lack of committed new stock points to a potential swing back to tighter conditions once demand stabilises.

The “flight to quality” trend continues to define leasing dynamics, with tenants seeking modern, amenity-rich and ESG-aligned space. Premium vacancy sits at 10.8%, well below the market average, while A-Grade has jumped to 18.5% and B-Grade remains elevated. Much of the recent leasing activity reflects tenants upgrading from secondary stock, reinforcing the need for landlords of older assets to refurbish and reposition to stay competitive.

Perth CBD’s leasing market remains heavily influenced by the mining and resources sector, which continues to anchor demand for large, high-quality office space. Recent major deals, such as Fortescue’s new headquarters lease, highlight how strongly the city’s office dynamics are tied to resource industry performance. While this provides stability when commodity markets are buoyant, it also leaves Perth more exposed to shifts in global mineral demand and pricing, making sector concentration both a strength and a risk.

Despite Perth’s solid economic fundamentals, the CBD office market has entered a more measured phase. Leasing activity has moderated, with net absorption turning negative in H1 2025 as occupiers take longer to finalise commitments. Landlords are responding with stronger incentives and flexible deal structures, particularly in A-Grade assets where vacancy has edged higher. Investment activity remains selective, with limited major transactions so far this year. While prime buildings continue to hold value, secondary assets are facing more scrutiny. Overall, conditions point to a balanced environment that continues to favour tenants.

Tenant CS negotiates exclusively for tenants, securing sharper lease terms, real cost savings and hours back in your day. Put an expert in your corner so you can focus on what you do best.

Author

.png)

Share this article

Perth is currently a tenant’s market and is likely to remain that way for the foreseeable future. Here’s a quick snapshot ...

Perth’s CBD office vacancy increased by 1.9% to reach 17% in H1 2025, the highest level in four and a half years. The rise was driven by the completion of 9 The Esplanade, which added fresh supply to the market, coupled with subdued tenant demand through the first half of the year.

By grade, A-Grade assets bore the brunt, with vacancy jumping from 14.2% to 18.5%. Premium stock edged higher by 1.4 points to 10.8%, while B-Grade was largely steady, up just 0.1 points. Net absorption was negative at -4,599 sqm over the half.

Looking ahead, Perth faces a period of supply stability, with no further completions expected in the near term. The next development wave is mooted for 2030, with Lot 4 Elizabeth Quay and 15 The Esplanade in planning. Beyond this, 2031 may bring projects such as the Convention Centre and The Mill.

With limited new supply in the pipeline but demand still soft, we expect vacancy to edge higher over the next 12–18 months before gradually beginning to decline as the market rebalances.

Face rents have recorded modest growth since H2 2024, with increases across all asset grades. Premium rents rose 1.7% to $788/sqm, while A and B Grade each lifted 2.7%, to $690/sqm and $488/sqm respectively.

Effective rents also moved higher, supported by stable incentives. Premium effective rents grew 2.1% to $435/sqm, A Grade edged up 0.6% to $435/sqm, and B Grade surged 8.8% to $248/sqm.

Incentives showed minimal change compared to H2 2024, with the exception of B Grade, which increased by 2.5% to 52%. Premium and A Grade held steady at 45% and 47% respectively. On an annual basis, incentives have declined by 2.5 percentage points in Premium, and by a marginal 0.1 point in B Grade.

Subleasing in the Perth CBD sits at 1.4% of total stock, or 25,664 sqm, in H1 2025, a slight decrease of around 1,800 sqm compared with late 2024.

This follows a period of sharp growth through 2024 and into early 2025, when sublease availability climbed to 1.5% of stock (26,800 sqm). The uplift was largely driven by major occupiers including Chevron, which placed 7,400 sqm on the market at One The Esplanade, and Worley at Dynons Plaza. Even with these increases, sublease levels remained below the 10-year average of 37,000 sqm, with the bulk of activity stemming from the mining and resources sector as well as professional, scientific and technical services.

Some of the recent notable commitments shaping the Perth CBD market include:

With Nine The Esplanade now completed, Perth CBD has entered a period with no new supply due in the near term. The next potential projects, Lot 4 Elizabeth Quay and 15 The Esplanade, are mooted for around 2030, with larger developments such as the Convention Centre redevelopment and The Mill flagged for 2031.

In the short term, subdued demand means vacancy is expected to edge higher over the next 12–18 months before gradually tightening as supply remains constrained. This keeps conditions firmly in favour of tenants for now, with landlords competing on incentives and flexibility. Over the medium to long term, however, the lack of committed new stock points to a potential swing back to tighter conditions once demand stabilises.

The “flight to quality” trend continues to define leasing dynamics, with tenants seeking modern, amenity-rich and ESG-aligned space. Premium vacancy sits at 10.8%, well below the market average, while A-Grade has jumped to 18.5% and B-Grade remains elevated. Much of the recent leasing activity reflects tenants upgrading from secondary stock, reinforcing the need for landlords of older assets to refurbish and reposition to stay competitive.

Perth CBD’s leasing market remains heavily influenced by the mining and resources sector, which continues to anchor demand for large, high-quality office space. Recent major deals, such as Fortescue’s new headquarters lease, highlight how strongly the city’s office dynamics are tied to resource industry performance. While this provides stability when commodity markets are buoyant, it also leaves Perth more exposed to shifts in global mineral demand and pricing, making sector concentration both a strength and a risk.

Despite Perth’s solid economic fundamentals, the CBD office market has entered a more measured phase. Leasing activity has moderated, with net absorption turning negative in H1 2025 as occupiers take longer to finalise commitments. Landlords are responding with stronger incentives and flexible deal structures, particularly in A-Grade assets where vacancy has edged higher. Investment activity remains selective, with limited major transactions so far this year. While prime buildings continue to hold value, secondary assets are facing more scrutiny. Overall, conditions point to a balanced environment that continues to favour tenants.

Tenant CS negotiates exclusively for tenants, securing sharper lease terms, real cost savings and hours back in your day. Put an expert in your corner so you can focus on what you do best.